Is Faye Travel Insurance worth using? With so many companies out there, how do you pick the right one? This is my first hand experience buying, filing a claim, and getting reimbursed with Faye on my most recent trip to Japan.

By the way, Faye asked me to test and review their product, and any links in this post that you purchase through support me at no extra cost to you. However getting sick on my trip, fully utilizing the insurance, and filing a claim weren’t planned (how could it be?) and the following is my first-hand account of how it all went down:

Buying Faye Travel Insurance

I looked around for some doctors on Google maps before picking one who had stellar reviews and took walk ins. Before seeking medical care in Kyoto, I checked the app and read my policy again to make sure I didn’t have to use a pre-approved doctor or get any paperwork specific to my insurance for the doctor to fill out – two areas where claims sometimes get denied by travel insurance providers.

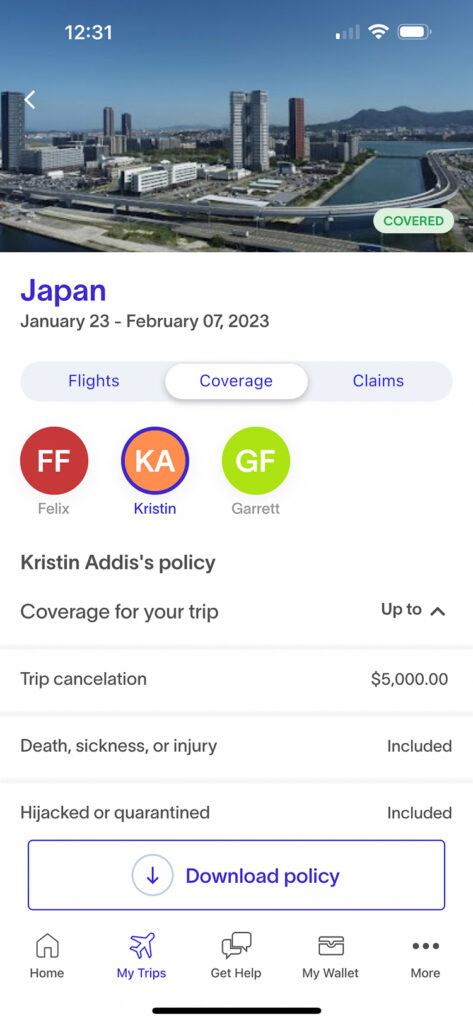

Faye is the first travel insurance that encouraged me to download an app for my trip. I input my flight details and had the insurance coverage info noted in the app as well.

Faye had quite a different interface, though. It felt much more human to me.

Most travel insurance is not a complete one size fits all product. If you’re traveling with super expensive camera gear, for example, read the fine print and decide if you need an additional policy to cover your gear (you probably do). Make sure the trip interruption and cancellation suit your desires and expectations, and get clear on coverage for certain activities you’re participating in. Additionally, buy insurance as soon as you put down your trip deposits, as you lose pre-existing medical coverage if you wait more than 14 days from that initial purchase.

For the most part, insurance is something you buy and forget about, until you really need it.

Using the App

Once I purchased, I was emailed the policy summary as well as the full coverage pamphlet.

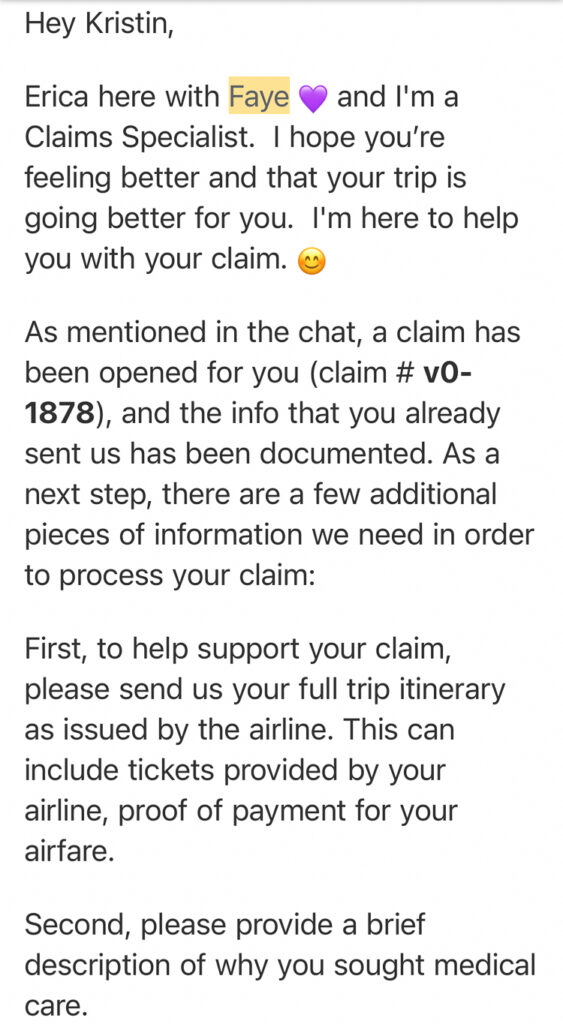

I received my first email on February 10, about two weeks after initiating the chat. It was from a real person, and she was my point of contact from then onward. I provided proof of the trip (flight receipts) and sent a brief description of why I sought care per her email instructions. It took me maybe 3 minutes to collect the info and briefly describe my symptoms and why I sought care.

Getting Medical Care Abroad

Since I did get sick, the app came in handy when I needed to make a claim.

Unfortunately, I developed a cough that re-awakened my childhood asthma during my first few days in Japan. It was tough to sleep due to the wheezing.

Of all the insurance I’ve used, this is one that I will use again.

Making a Claim with Faye

Price-wise, it worked out to under 0 per person for our two-week trip. My policy included up to 00 in trip interruption coverage, including inconveniences like delays, rental lock-outs, delays at security, and late arrival.

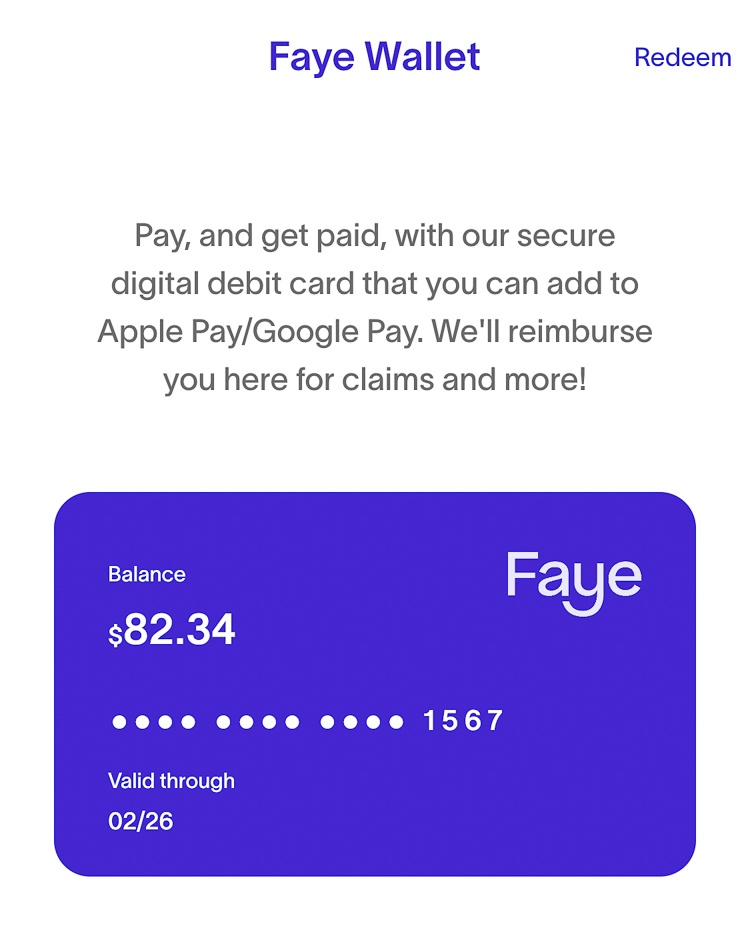

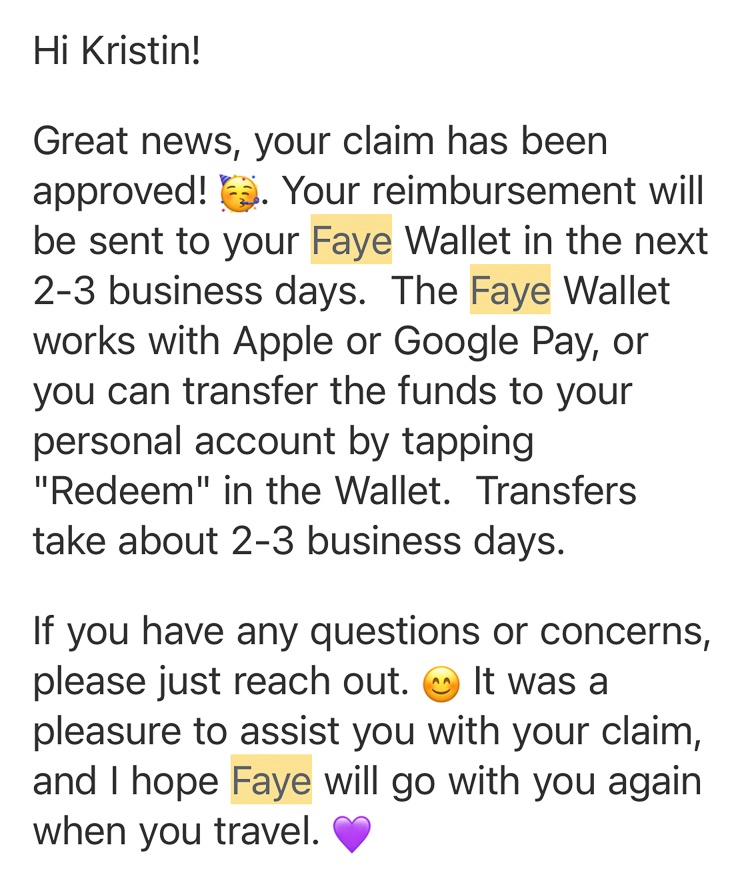

A handful of days later, I received a claims summary and soon thereafter was informed my claim had been approved in full.

Immediately after coming back from my appointment, I opened the app and started chatting with Faye. I wanted to see if it was really that easy to file a claim, get it approved, or if I would run into a bunch of red tape.

I was honestly shocked I hadn’t needed to call, follow up, or argue my case any further. It’s how it should be, but it’s just not what I’ve come to expect from insurance.

Although travel insurance is an additional trip expense, it’s one of those things that’s important to have when you really need it. Thankfully my medical expenses were low, but you never know! Depending on the severity of the situation, I could have been tens of thousands in the hole without coverage.

I was honestly impressed by how easy the whole process was from purchasing insurance, to understanding what I needed to do to get reimbursed, to actually getting reimbursed. As mentioned earlier, the whole thing felt straightforward, personalized, and human, which isn’t usually how insurance feels to me.

My Take on Faye

I took photos of the receipts and uploaded them to the chat. I didn’t let them know that I was writing this review. I wanted to be treated like a normal customer and have the same experience that anyone would have.

Keep in Mind

You’ll begin by putting in your location, dates, and amount of travelers with you. The policy quote will have the main points, with a link at the bottom to read the full policy. Keep in mind that preexisting conditions can be covered as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

You can explore your options here!

Not seeing any requirements like that, I made my appointment, got there, and paid in cash. The appointment and medications came out to just under USD . I received a receipt detailing the diagnosis along with the medications prescribed and what I paid. It was two pages in total.

*This post was brought to you in partnership with Faye Travel Insurance. All opinions on the travel insurance are my own, as always. Your trust comes first!

Based on my experience I would absolutely recommend Faye travel insurance. It was quick, easy, and I liked having access to a person I could chat with when I really needed it. No hours on the phone, no headaches, and no feeling like I was ignored.

Buying travel insurance usually starts with inputting dates, reading as much fine print as possible, and hoping it all works out if you need to make a claim. Having used four different companies over the past decade, it’s been a similar experience every time.