Alternatively, you can use your bank’s digital banking tools to initiate and complete the transaction. This option depends on whether your bank’s online banking platforms have the option. The details you require are the recipient’s name, address, bank name, bank swift code, and account number. Some banks will ask for more details.

After submitting the details, the bank will use an online communication tool to process the transaction and the customer will receive the funds after a while. It takes a few hours to a few days for the transfer to go through.

International wire transfer

The only challenge with cryptocurrencies is how volatile they are. It is not uncommon for the price of the digital currency to contract or rise by as much as 10% on a daily basis. As such, you should only use the option when the recipient is comfortable with it.

To use these platforms, you just need to have an account and a way to transfer the funds. Most of them allow sending the funds from your debit or credit card, which comes in handy when you are traveling.

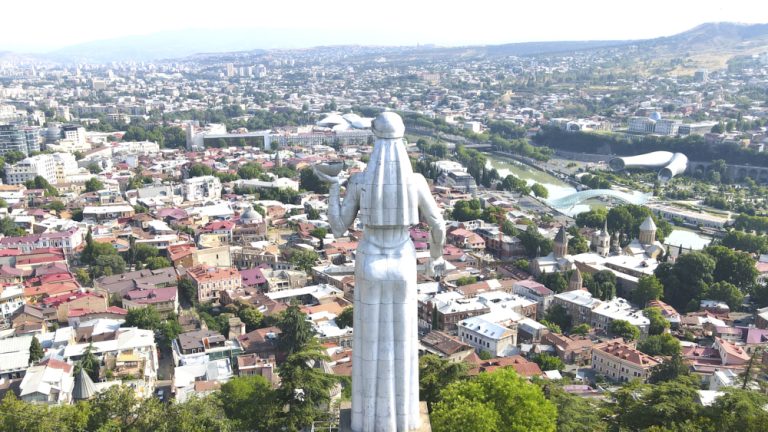

Mexico is one of the biggest recipients of remittances globally. In 2020, the country received more than billion in remittances from around the world. This amount represented about 4% of the country’s GDP. So, in this article, we will look at some of the top options of sending money to Mexico when you are traveling.

Online money transfer companies

Another option of sending money to Mexico when travelling is cryptocurrencies like Bitcoin and Litecoin. These digital coins have become popular these days because of their speed, cost, and anonymity. You need two things to use them.

First, there are companies that PayPal and Skrill that allow you to send funds to the recipient’s digital account. After receiving the funds, the customer can withdraw it into their bank account or spend it online.

The process of sending money to Mexico is relatively easy these days no matter where you are. The overall cost and the period of completing the transaction has declined considerably. Also, the number of available options of sending funds to the country have risen. Before you send, consider the overall cost of sending, the delivery time, and the option that is ideal for your recipient.

Before you use the services, we recommend that you use a money transfer comparison service to check the fees charged and the amount the customer will receive. These companies use technology that compares fees instantly from hundreds of providers.

Use cryptocurrencies to send money

An international wire transfer is a simple money transfer method that involves two banks and other intermediaries behind the scenes. This works in two main ways. First, you can go to a bank branch and submit the recipient’s bank details.

Another option that you can use to send money to Mexico when travelling is online money transfer companies, such as MoneyTransfers.com. These are firms that have digital tools to facilitate these payments. There are several types of these firms.

First, you need to have an account with an exchange like Coinbase or Binance. Second, you need the recipient’s wallet address. After this, you just need to select the currency you want to send, the amount, and the recipient’s address. They can then withdraw the funds into their bank account.

Summary

Second, there are companies that allow you to send money digitally to a recipient’s bank account. Companies like Wise, Remitly, and PaySend use technology to quickly send funds to the account. The recipients can also collect their funds at a local agent or have it go to their mobile wallets directly.